Zurück zum Blog

Zurück zum Blog

Dieser Artikel ist derzeit in Ihrer Sprache nicht verfügbar. Für Englisch wird ein automatischer Übersetzer empfohlen.

Mastering Candlestick Patterns: A Comprehensive Guide for Traders

Letztes Update: 08/30/2024

Candlestick Patterns: Guide for Traders

Candlestick patterns are vital instruments for traders, providing significant insights into market emotions and price fluctuations. These formations, created from the opening, highest, lowest, and closing prices of an asset during a designated timeframe, are key to making well-informed trading choices. By recognizing possible market reversals or trends, candlestick patterns can assist you in improving your trading decisions and potentially boosting your profits. This resource aims to offer a comprehensive understanding of how candlestick patterns function, their elements, and techniques for effectively incorporating them into your trading strategy.

How Are Candlesticks Formed on a Trading Chart?

Candlesticks provide an in-depth perspective on market dynamics, highlighting shifts in strength, direction, and emotional factors affecting price movements. Each candlestick encapsulates price information for a designated time frame—such as one trading day on a daily chart or one hour on an hourly chart. The elements of a candlestick consist of the opening, closing, highest, and lowest prices for that specific period.

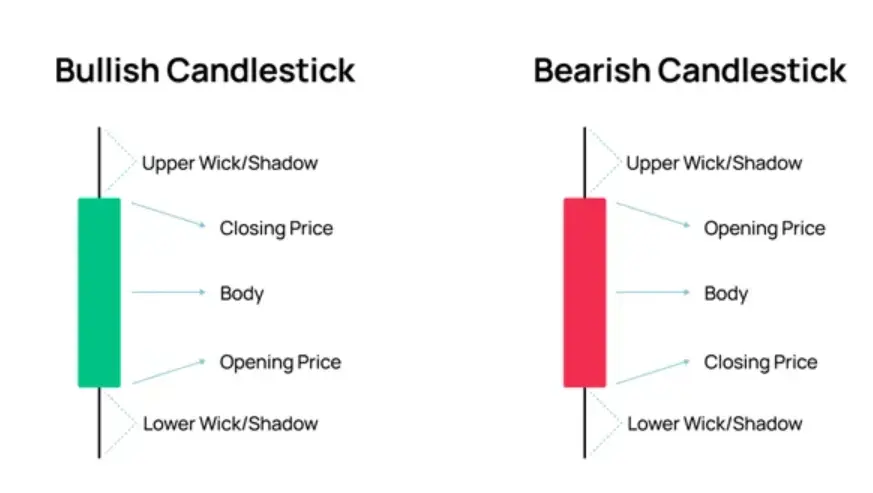

Candlestick Components:

Close Price: The last price at which an asset trades during the time period.

High Price: The highest price reached during the time period.

- Low Price: The lowest price reached during the time period.

The Candlestick Body: The body of the candlestick is the area between the opening and closing prices. Its color indicates the direction of price movement:

Green (or white): Signifies a bullish trend, where the closing price is above the opening price.

- Red (or black): Indicates a bearish move, where the closing price is lower than the opening price.

- The length of the body provides information about the strength of the move. A long body suggests strong momentum, while a short body indicates weaker momentum.

Upper and Lower Shadows: The shadows (or wicks) are the slender lines that extend from the body. The upper shadow illustrates the range between the highest price and the closing price, while the lower shadow depicts the range between the lowest price and the opening price. Long shadows may indicate price rejection or potential resistance/support levels.

Reliable Trading Strategies

Candlestick patterns present an intriguing method for examining market behaviors and making educated trading choices. However, prior to exploring these patterns, it's important to establish practical expectations. As Edwin Lefèvre wisely stated in Reminiscences of a Stock Operator, “Simple profits in the stock market are the lure that ensnares the naive.” This serves as a warning against the temptation of rapid returns and highlights the necessity of careful analysis and strategic planning in trading.

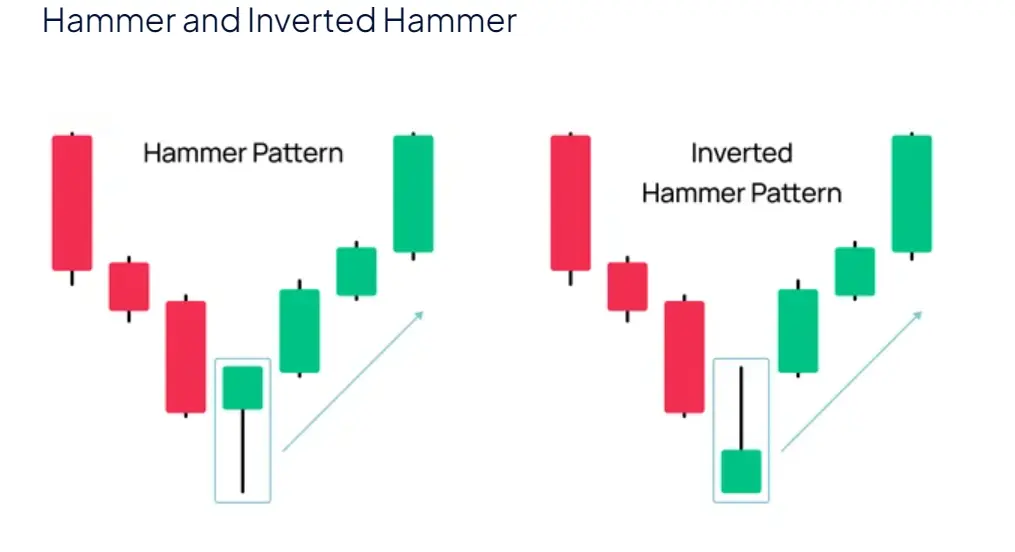

1. Hammer and Inverted Hammer

Hammer Pattern

The hammer is a bullish reversal pattern that emerges at the end of a downtrend, indicating that sellers are losing strength while buyers are beginning to take control. This pattern is characterized by a small body, a long lower shadow, and the absence of an upper shadow. The length of the lower shadow should be at least twice that of the body. The hammer can appear in either green or red.

Inverted Hammer Pattern

The inverted hammer resembles an upside-down hammer but still signifies a bullish reversal. It indicates the potential conclusion of a downtrend and a possible upward trend reversal. Its features are similar to those of the hammer, but they are inverted.

Strategy: Seek out these patterns at crucial support levels or following notable downtrends. Confirm their presence with volume and other indicators to enhance reliability.

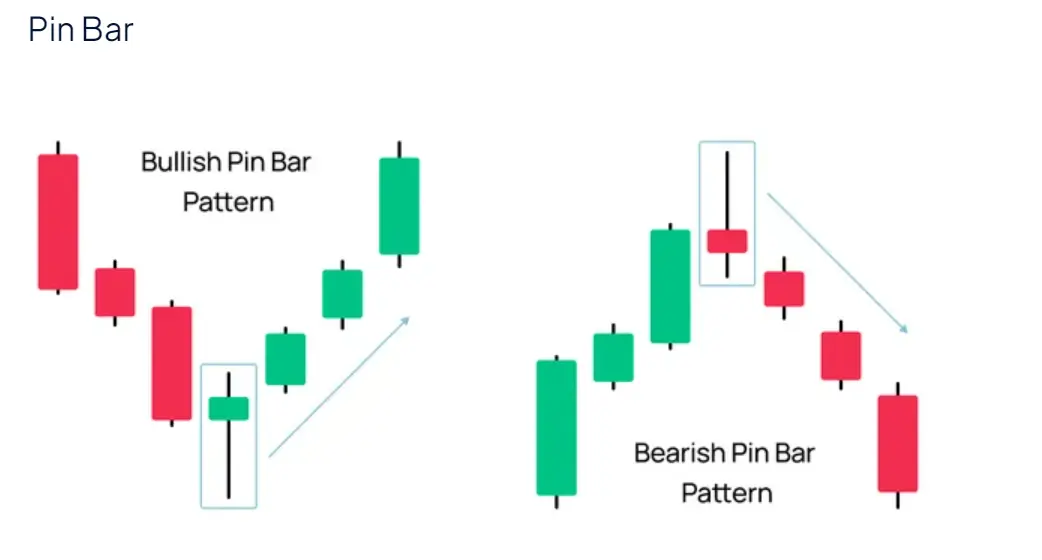

2. Pin Bar

Bullish Pin Bar

This pattern is characterized by a lengthy lower shadow, a diminutive body, and a brief upper shadow. The lower shadow should account for at least two-thirds of the entire candlestick length. It signifies a possible reversal or continuation of the trend following a retracement.

Bearish Pin Bar

The bearish pin bar displays a long upper shadow, a small body, and a short lower shadow. This pattern indicates a potential bearish reversal when it appears near significant resistance levels.

Strategy: Employ the pin bar around support and resistance zones, trendlines, or moving averages for improved accuracy. Validate with additional indicators.

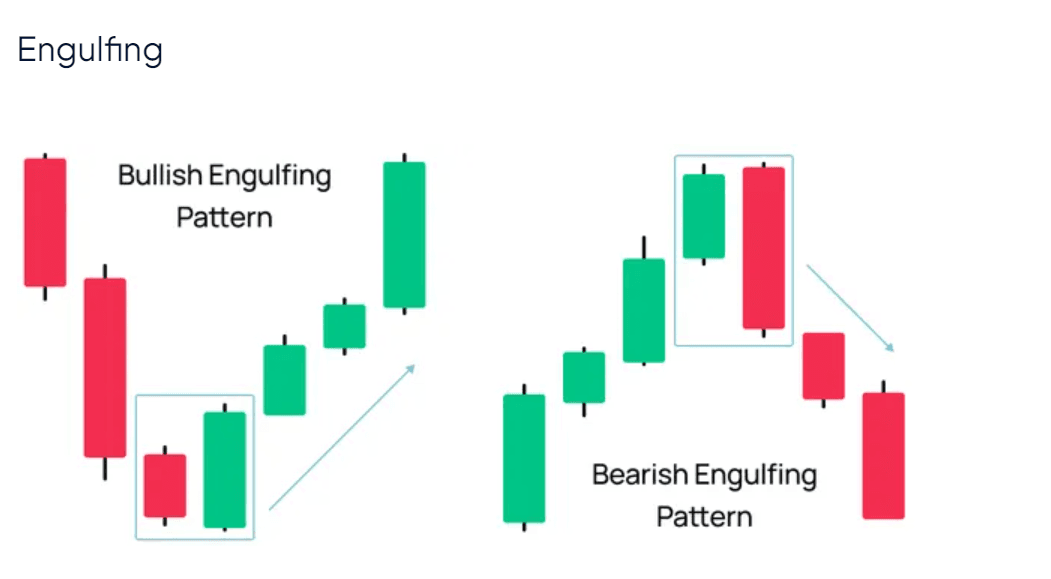

3. Engulfing

Bullish Engulfing

This pattern appears when a red candlestick is succeeded by a larger green candlestick that completely envelops the former. It indicates that buyers have gained dominance and hints at a potential upward movement.

Bearish Engulfing

The bearish engulfing pattern is the reverse, characterized by a green candlestick followed by a larger red candlestick that eclipses the earlier one. This suggests that sellers have taken control, which may result in a price drop.

Strategy: Seek out these patterns following a pullback or at points of trend reversal. It's essential to confirm with volume and trend analysis.

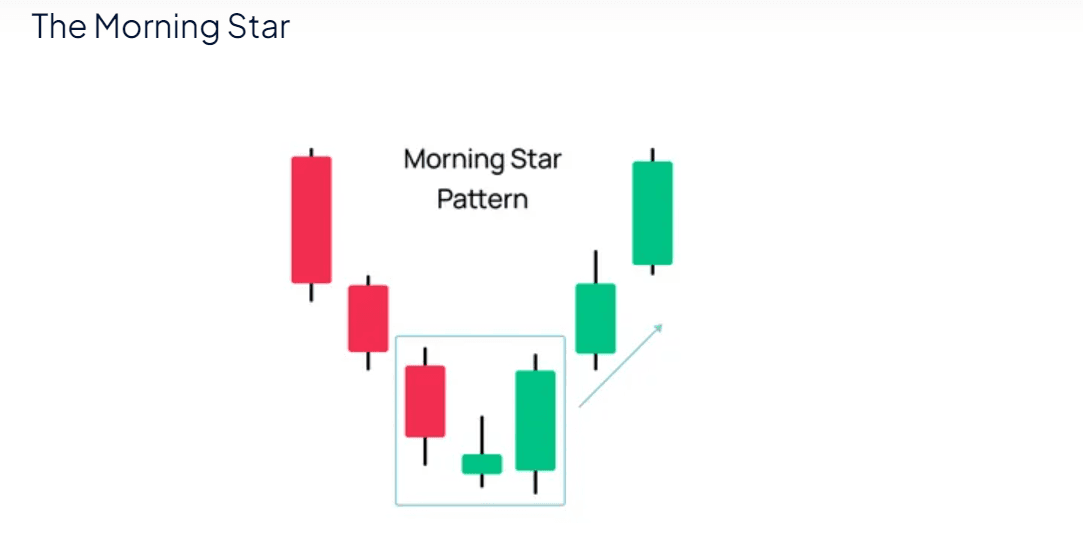

4. Morning Star

Morning Star Pattern

This is a three-candlestick pattern that signals a bullish reversal after a downtrend. The initial candlestick is bearish, succeeded by a small-bodied candlestick (which can be any color), and concluding with a bullish candlestick whose body is at least as large as that of the first.

Strategy: Best utilized at the conclusion of a downtrend, confirmed by volume and additional bullish signals.

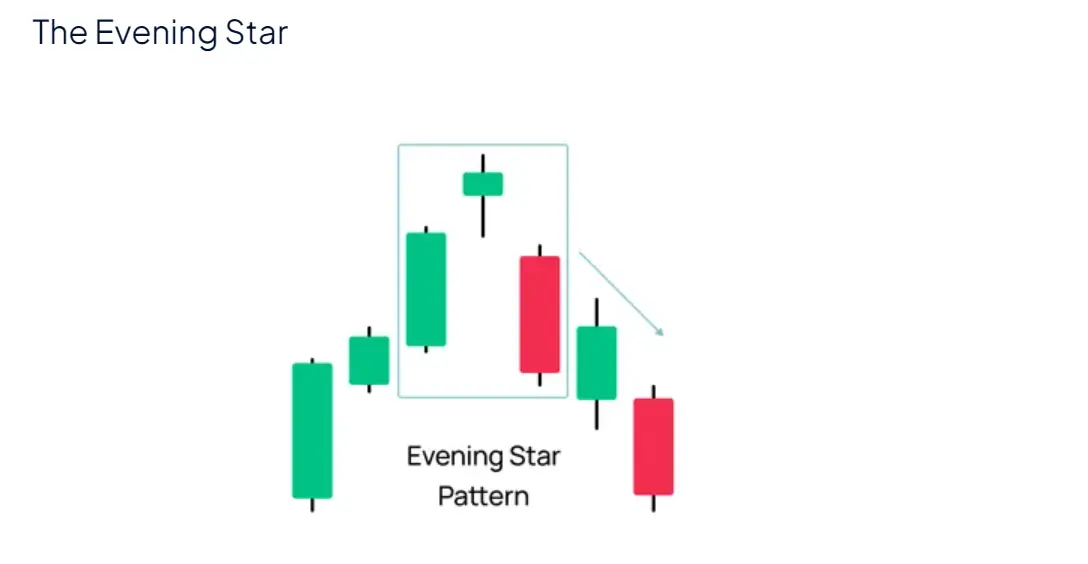

5. Evening Star

Evening Star Pattern

This pattern serves as the bearish equivalent of the morning star, indicating a possible reversal towards a downward trend. It begins with a bullish candle, is succeeded by a small-bodied candle, and concludes with a larger bearish candle.

Strategy: Most effectively identified at the conclusion of an uptrend, and should be validated with further bearish indicators and volume.

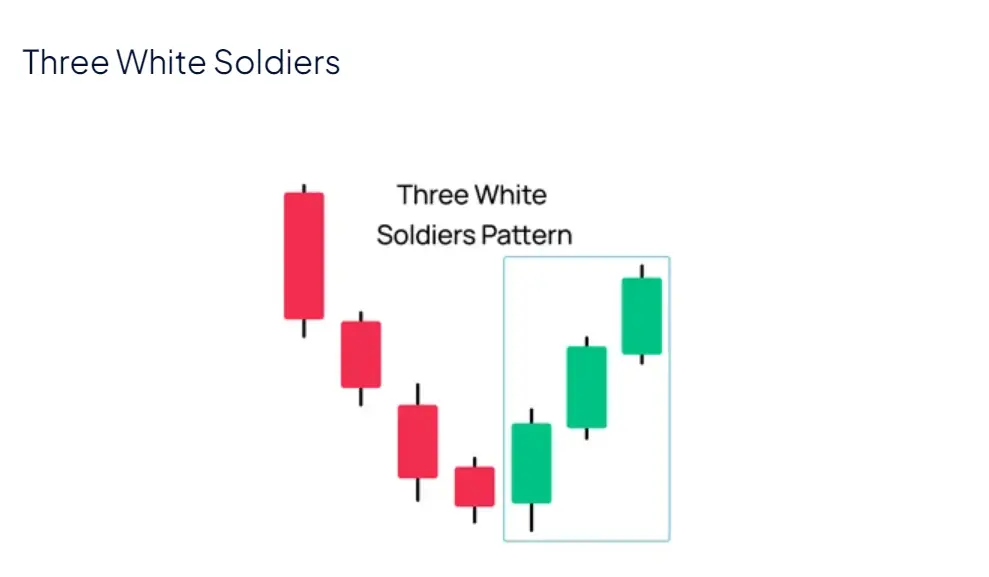

6. Three White Soldiers

Three White Soldiers Pattern

This pattern is made up of three successive bullish candlesticks characterized by short wicks, indicating a robust bullish reversal, particularly after a downtrend.

Strategy: Utilize this pattern to spot possible long positions or to enhance current ones, while corroborating with additional bullish signals.

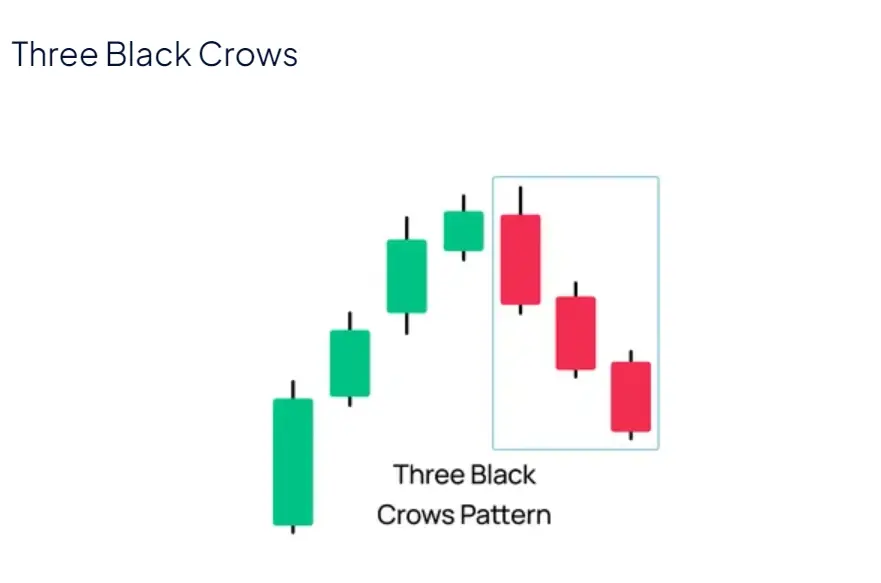

7. Three Black Crows

Three Black Crows Pattern

This pattern consists of three back-to-back bearish candlesticks, signaling a reversal to the downside following an upward trend. Each candlestick begins close to the prior close and finishes lower.

Strategy: Identify this pattern at the peak of an upward trend, validating it with bearish indicators and trading volume.

8. Dark Cloud Cover

Dark Cloud Cover Pattern

This pattern consists of two candles: a lengthy green candlestick is succeeded by a lengthy red candlestick that begins above the prior closing price but finishes below its halfway mark. This suggests a possible conclusion to the upward trend.

Strategy: Use this pattern to predict a reversal, validating it with bearish signals.

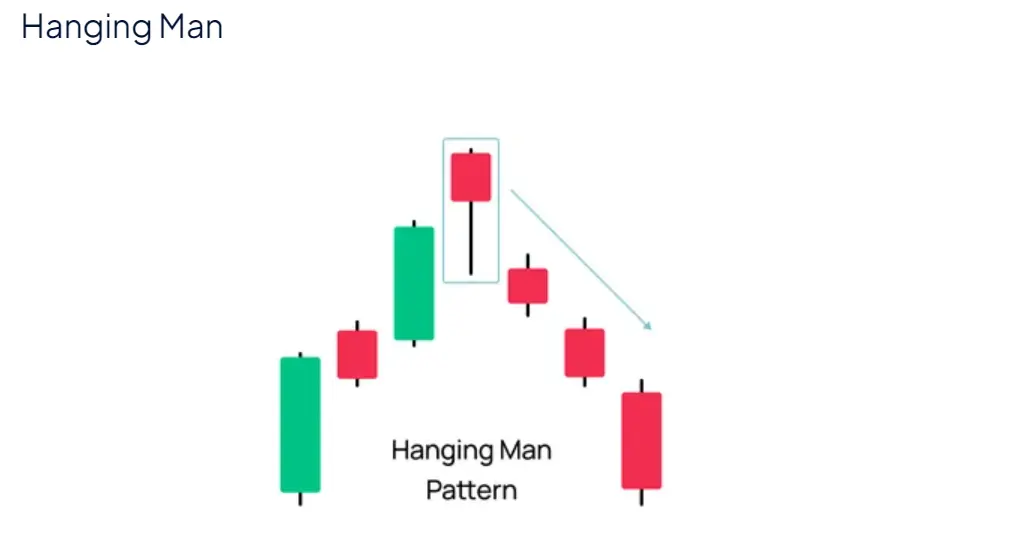

9. Hanging Man

Hanging Man Pattern

Typically appearing after an uptrend, this bearish signal has a small body at the top and a long lower shadow. The lower shadow should be at least twice the length of the body.

Strategy: Seek out this formation during an uptrend and validate it with bearish indicators prior to taking action.

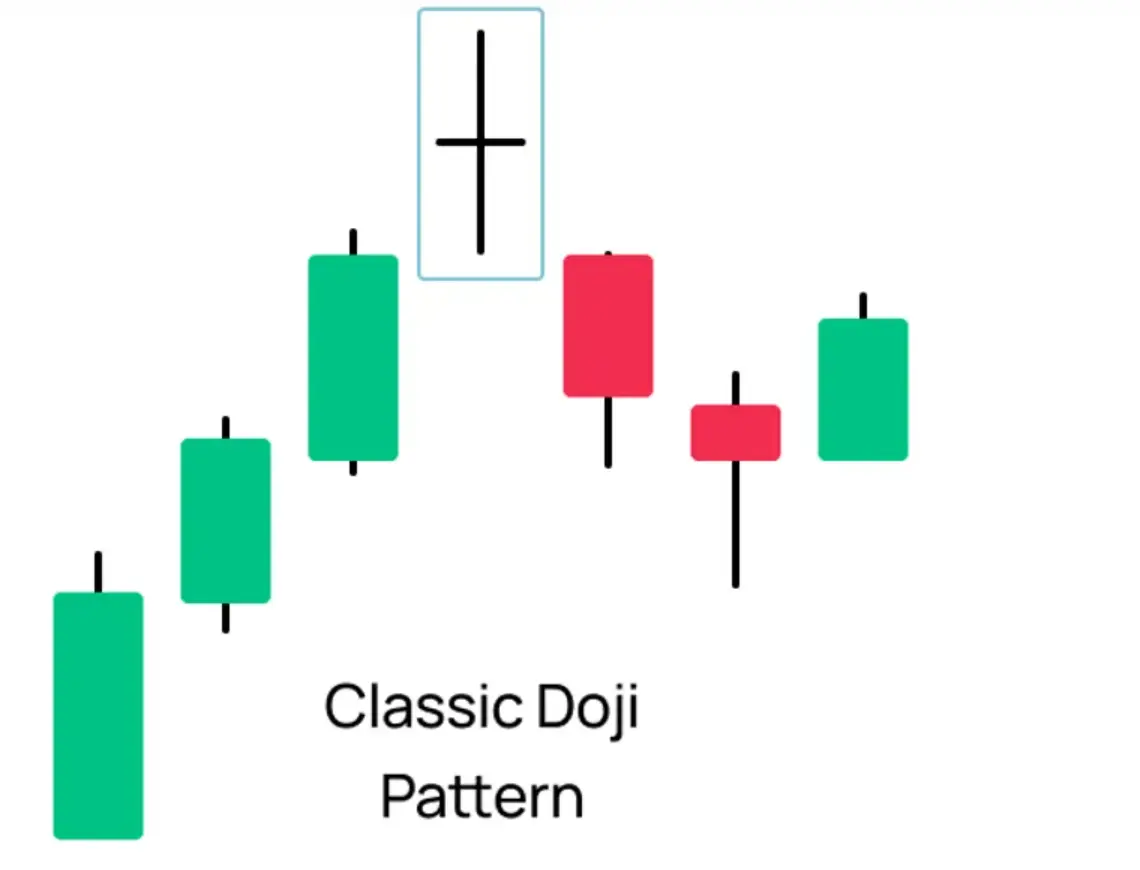

10. Doji

Doji Pattern

A doji signifies uncertainty in the market, where the opening and closing prices are almost identical. It reflects a state of balance and prudence within the trading environment. Variations such as the gravestone doji and dragonfly doji exist, each carrying distinct meanings.

Strategy: Use doji patterns as indicators for possible reversals or periods of consolidation, reinforcing findings with further analysis.

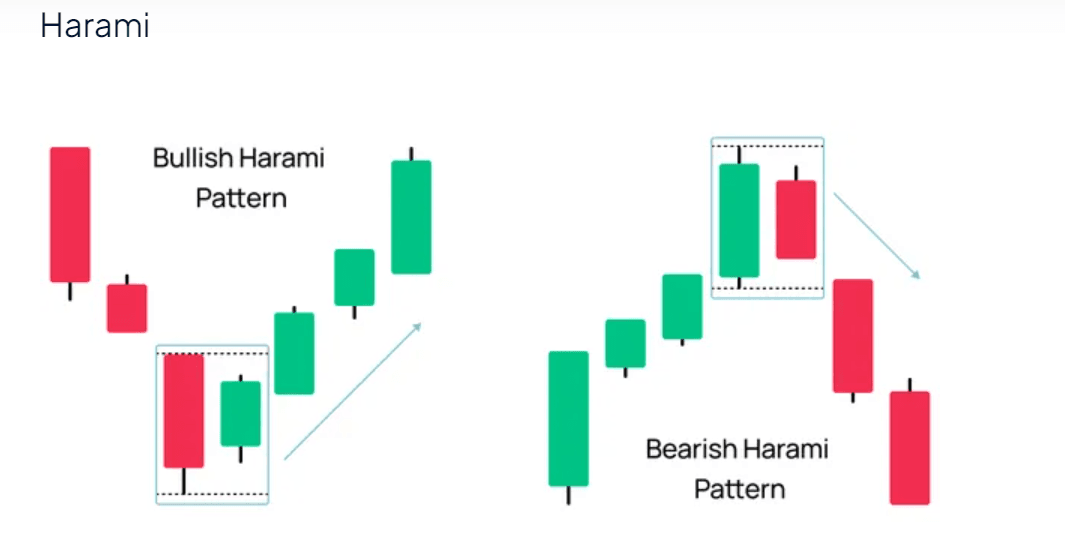

11. Harami

Bullish Harami

In an upward trend, this formation features a significant red candlestick succeeded by a smaller green candlestick that is entirely contained within the body of the preceding candlestick. This pattern signals a possible reversal.

Bearish Harami

In a downward trend, this pattern comprises a large green candlestick followed by a smaller red candlestick. It suggests a potential shift to the downside.

Strategy: Seek out harami patterns in trending markets to spot potential reversals.

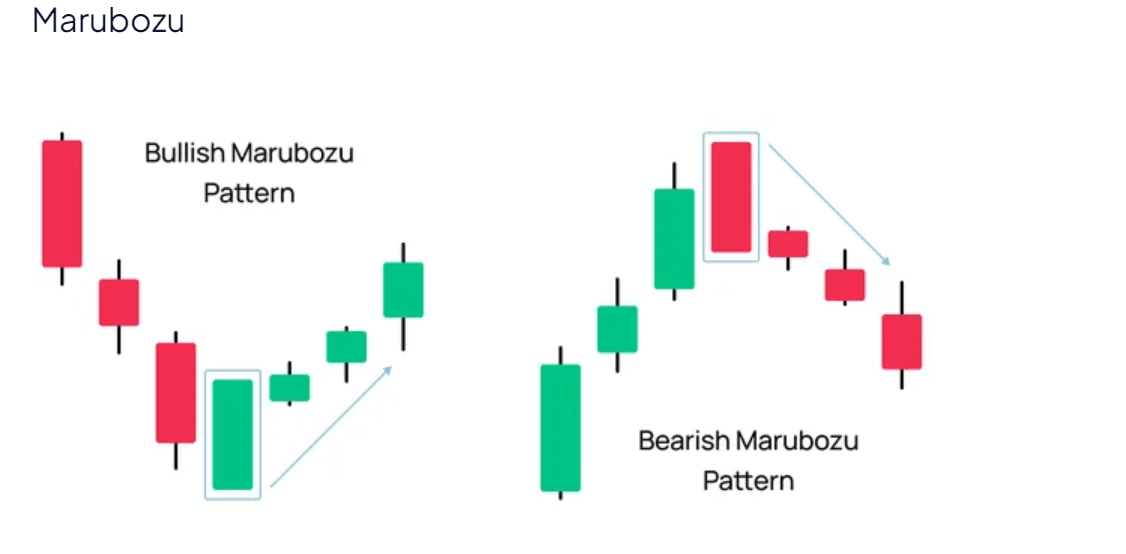

12. Marubozu

Bullish Marubozu

A lengthy green candlestick devoid of shadows, signifying robust buying dominance from the opening to the closing price. This implies that the upward trend is likely to persist.

Bearish Marubozu

A lengthy red candlestick without shadows, indicating powerful selling dominance from the opening to the closing price. This suggests that the downward trend is likely to continue.

Strategy: Utilize marubozu patterns to validate trend continuations, particularly following retracements.

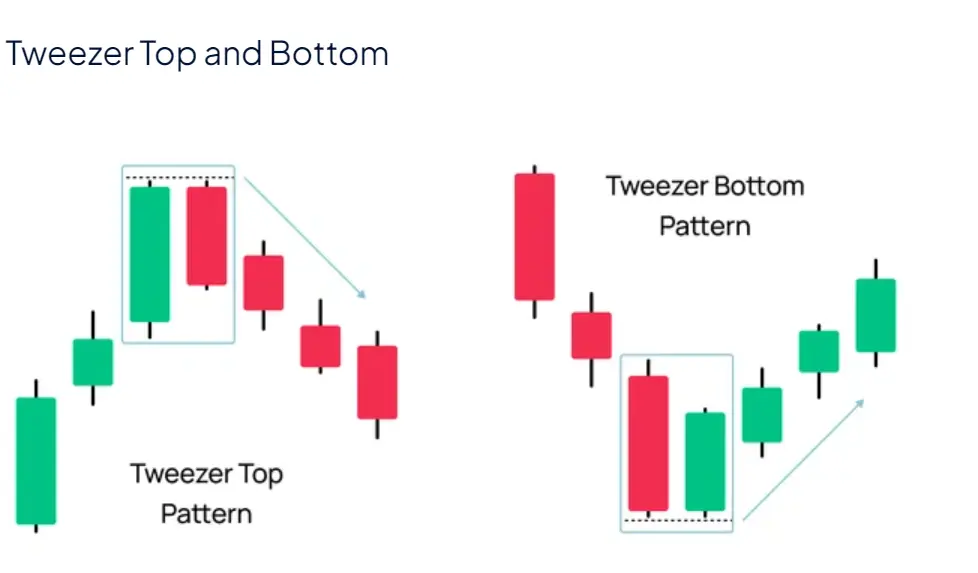

13. Tweezer Top and Bottom

Tweezer Top

Formed in an uptrend, this pattern features two candlesticks with the same high, signaling a potential reversal.

Tweezer Bottom

Occurring in a downward trend, this pattern presents two candlesticks with the same low, hinting at a potential upward reversal.

Strategy: Look for tweezer patterns at important peaks or troughs to pinpoint possible trend reversals.

Frequently Asked Questions (FAQ)

Do chart patterns work in all financial markets?

Yes, candlestick patterns can be identified in any financial market, but their reliability may vary based on market conditions, volatility, and trading strategies.

What is the most accurate candlestick pattern?

The accuracy of candlestick patterns depends on market conditions. Patterns like the Bullish Engulfing and Bearish Engulfing are often considered highly reliable.

What is the most powerful candlestick pattern?

Patterns such as the Hammer and Inverted Hammer (for bullish reversals) and the Shooting Star and Hanging Man (for bearish reversals) are considered powerful due to their ability to signal potential changes in market direction.

What is the 3-candle rule?

The 3-candle rule involves looking for three consecutive candlesticks to confirm a trend continuation or reversal. It is used as a confirmation tool for trend direction.

Do professional traders use candlestick patterns?

Yes, many professional traders incorporate candlestick patterns into their trading strategies. These patterns help in understanding market sentiment and making informed trading decisions, often in conjunction with other analytical tools.

For which type of trader are candlestick patterns most effective?

Candlestick patterns are useful for all types of traders. Day traders might use them for quick decisions, while position traders might rely on them for longer-term trends.

How can I combine candlestick patterns with other technical analysis tools?

Integrate candlestick patterns with tools like moving averages, volume, Bollinger Bands, Fibonacci retracements, and trendlines to enhance your trading strategy. This combination offers a more comprehensive approach to market analysis.

Are there specific market conditions where candlestick patterns are more effective?

Candlestick patterns are more effective in high volatility, consolidation phases, strong trending markets, key support and resistance zones, and at market openings. Recognizing these conditions can help in making more accurate trading decisions.

In the words of Jesse Livermore, “The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer.” Mastery in trading involves understanding and integrating various technical tools, with candlestick patterns forming a foundational element in this sophisticated approach.