Zurück zum Blog

Zurück zum Blog

Dieser Artikel ist derzeit in Ihrer Sprache nicht verfügbar. Für Englisch wird ein automatischer Übersetzer empfohlen.

Harmonic Price Patterns: A Precise Tool for Successful Trading

Letztes Update: 08/26/2024

In the world of trading, market prices often exhibit trends or patterns that can signal whether a price will continue in its current direction or reverse. Among the tools traders use to identify these trends, harmonic price patterns stand out for their precision. These patterns, grounded in specific price movements based on Fibonacci retracements and extensions, reduce much of the subjectivity involved in pattern recognition, offering traders a more reliable method to predict future price movements.

Unlike some other chart patterns, harmonic patterns require patience. They are most effective when fully formed, but when correctly applied, they offer deep insights into potential market movements. Let’s delve into some of the most widely used harmonic patterns that can help traders make successful trades.

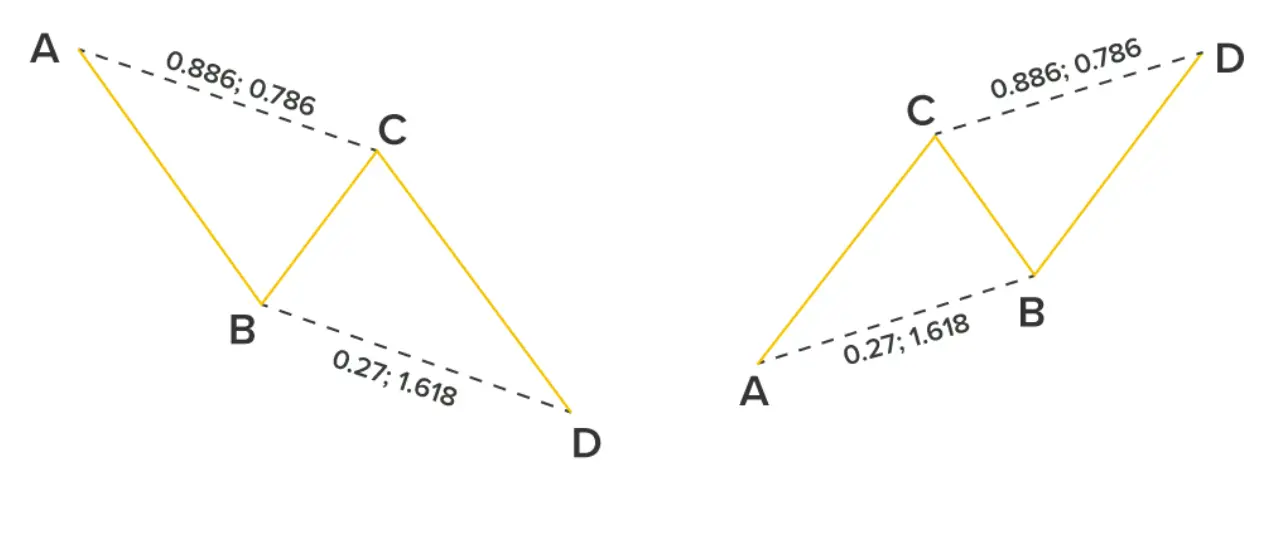

The ABCD Pattern

Often considered the simplest of all harmonic patterns, the ABCD pattern consists of four points and three distinct movements:

AB: The initial impulsive movement.

BC: The corrective movement.

- CD: The final impulsive movement.

The pattern is named based on the idea that the AB leg is equal in length to the CD leg. When applying the Fibonacci retracement tool to the AB leg, the BC leg should ideally touch the 0.618 level, ensuring that CD is equal in length to AB. Additionally, the time taken for C to reach D should be similar to the time taken for A to reach B. This allows traders to identify the Potential Reversal Zone (PRZ) near point C or wait for the pattern to complete before deciding on an entry point.

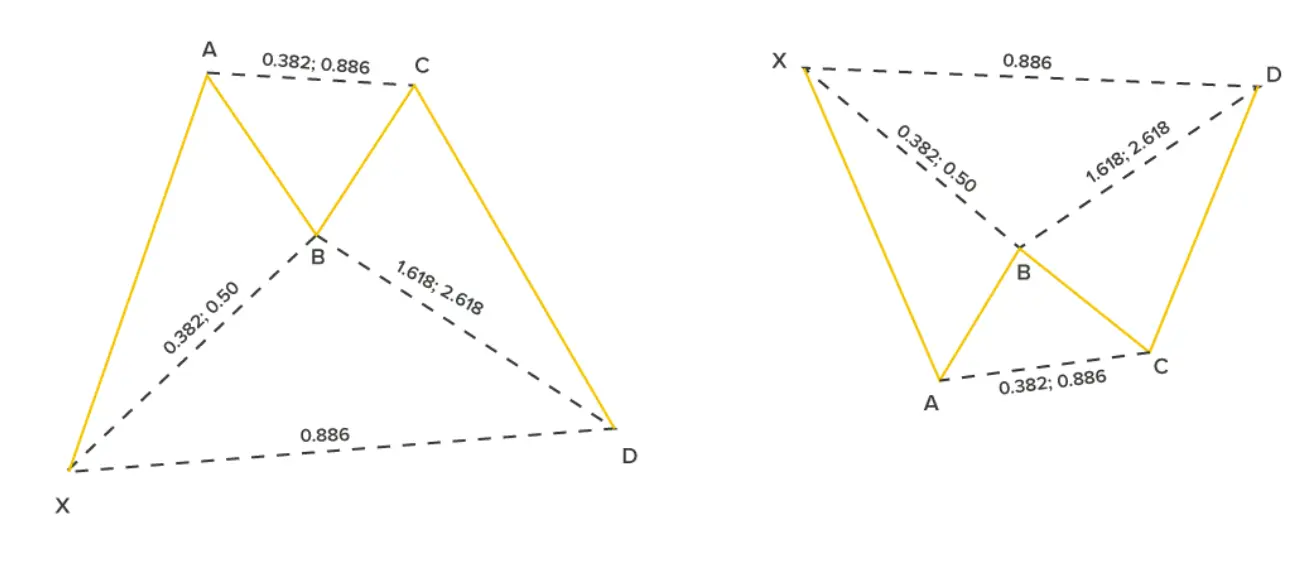

The BAT Pattern

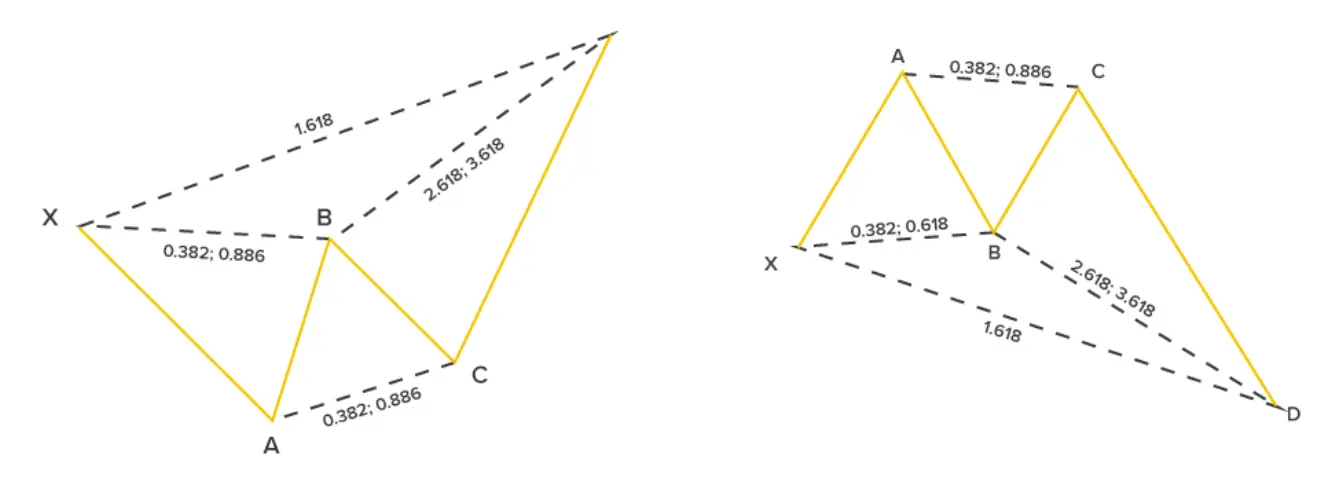

First identified by Scott Carney, the BAT pattern is another reliable harmonic pattern, especially for traders looking to capitalize on temporary trend reversals. The BAT pattern adds an extra point, X, to the typical ABCD structure, forming a 5-point retracement pattern.

The BAT pattern forms when the XA leg retraces to a BC retracement that halts at 50% of the XA movement. The CD leg must extend at least 1.618 of the BC leg, potentially reaching up to 2.618. If the CD leg falls short of this extension, the pattern is considered invalid. The PRZ is identified at point D, providing traders with a potential entry point.

The Gartley Pattern

Created by Harold McKinley Gartley, the Gartley pattern is another harmonic structure similar to the BAT pattern. This pattern typically forms after a significant high or low, signaling that a correction may be on the horizon.

For a valid Gartley pattern, certain conditions must be met:

AB should retrace 61.8% of the XA leg.

BC should retrace between 38.2% and 88.6% of the AB leg.

- CD should retrace a minimum of 78.6% of the XA leg.

When employing this pattern in a trading strategy, traders often place a stop-loss at point X and set their take-profit at point C.

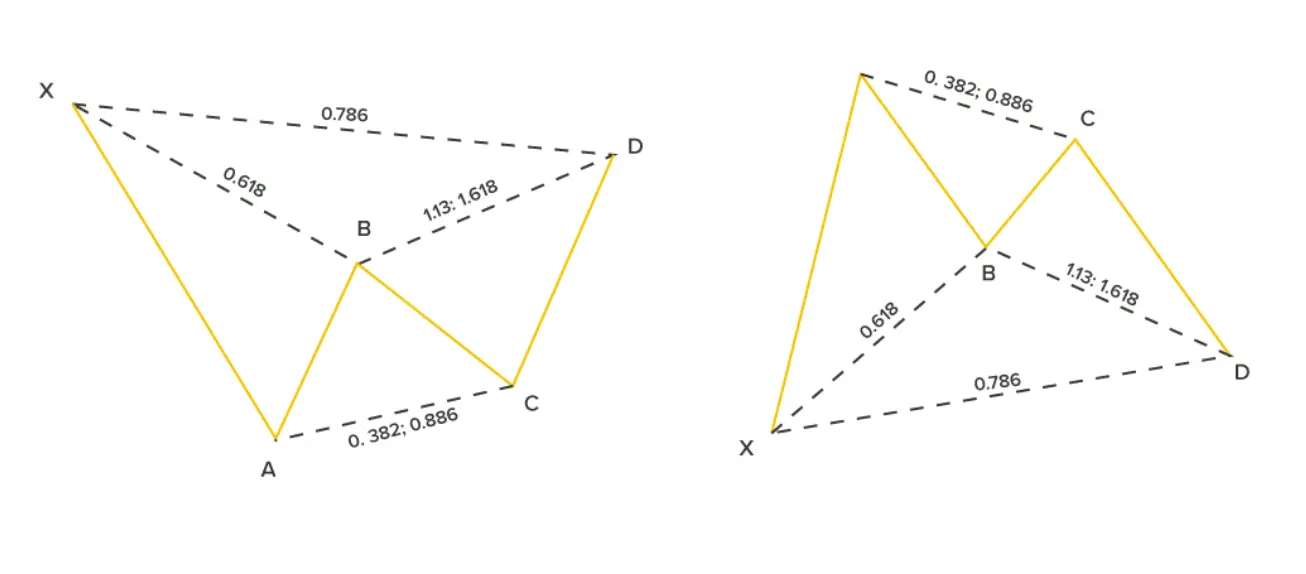

The Butterfly Pattern

The butterfly pattern, identified by Bryce Gilmore, is a reversal pattern often seen at the end of a trend. Like other harmonic patterns, it relies heavily on Fibonacci ratios and consists of four legs: XA, AB, BC, and CD.

The key ratio for identifying the butterfly pattern is a 0.786 retracement of the XA leg, which helps pinpoint point B and the subsequent PRZ, allowing traders to anticipate potential price reversals.

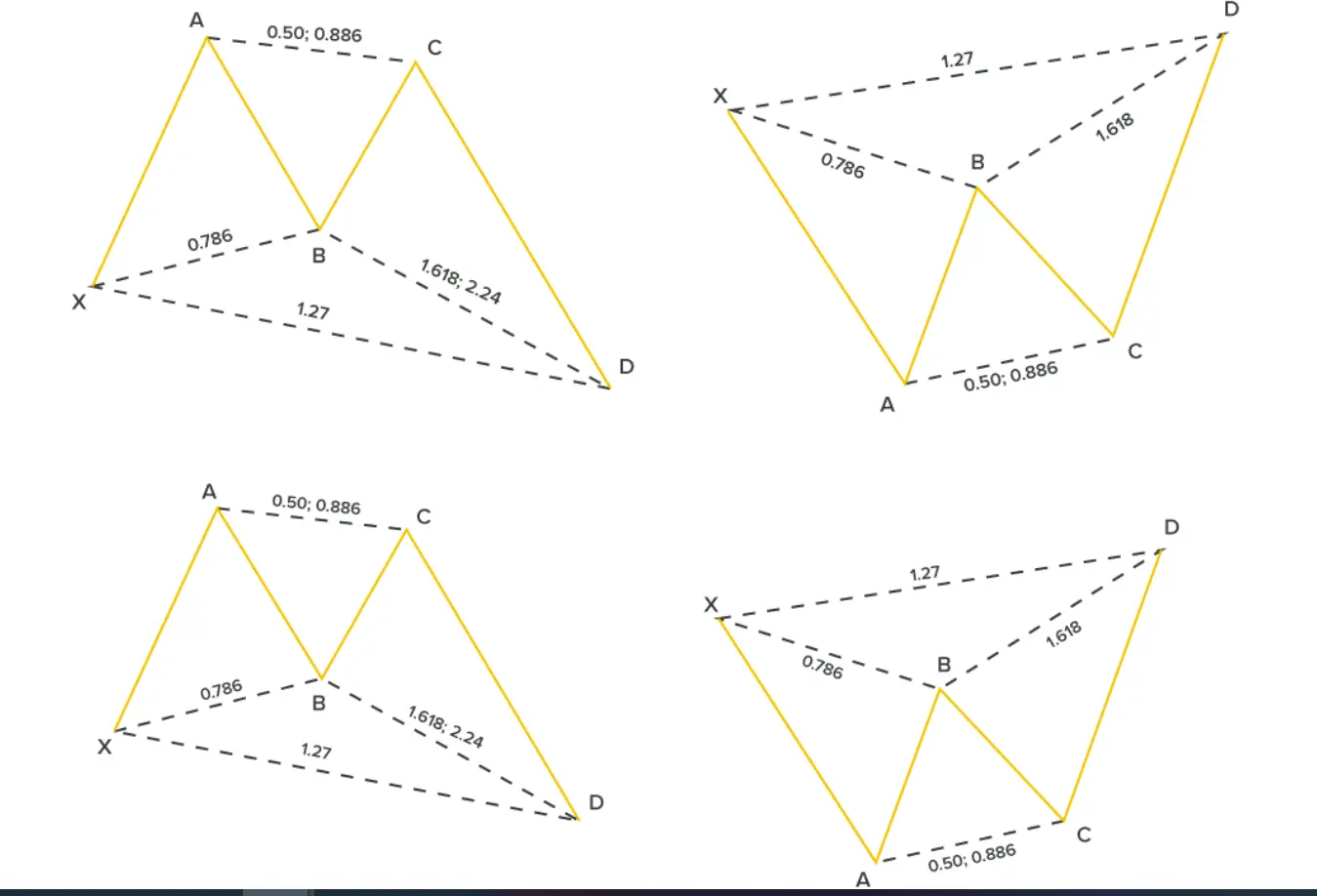

The Crab Pattern

The crab pattern is favored by traders looking to enter trades during extreme market highs or lows. This pattern also follows the X-A, A-B, B-C, and C-D structure but is distinguished by its 1.618 extension of the XA leg, which helps identify the PRZ.

In its bullish form, the crab pattern begins with a sharp rise from X to A, followed by a retracement in the AB leg between 38.2% and 61.8%. This is followed by a significant projection of the BC leg, which completes the pattern and signals a potential trend reversal. In its bearish form, the pattern starts with a dip from X to A, followed by a small price rise, a slight decline, and finally a sharp rise to point D.

Conclusion

Every trader aims for success, and harmonic patterns can be a powerful tool to help achieve that goal. When plotted correctly, these patterns offer a reliable method for predicting market movements and identifying potential trade opportunities. By mastering these patterns and understanding the underlying Fibonacci ratios, traders can enhance their ability to navigate the complexities of the financial markets.